Investment banking giant Goldman Sachs, which already has signaled it wants employees in the office five days a week, is nudging them again to follow through as data shows the U.S. return-to-office rate still struggles to cross major thresholds, especially on Fridays.

Low in-person office attendance remains a concern at commercial properties more than three years after office workers were sent home to work as a precaution at the outbreak of the COVID-19 pandemic.

“Since we communicated our approach for returning to the office, we have continued to encourage employees to work in the office five days a week,” Jacqueline Arthur, the firm’s global head of human capital management, said in an emailed statement to CoStar News. “While there is flexibility when needed, we are simply reminding our employees of our existing policy which is broadly in line with other leading firms in the industry.”

Goldman Sachs’ urging comes as its lower Manhattan headquarters was described as “totally dead” on Fridays with its summer interns having left and many employees choosing to work remotely to get an early start on the weekend, the New York Post previously reported, citing people familiar with the situation.

A Goldman Sachs spokesperson told CoStar News the company doesn’t have a work-from-home summer Friday policy and declined to comment further. The spokesperson also declined to comment on its current office use rate and whether employees would be penalized for not returning to the office full time.

About 75% of Goldman Sachs’ employees worked in the office on any given day of the week pre-pandemic, Chairman and Chief Executive David Solomon told CNBC in October, adding that rate recovered to about 65% at the time. Solomon said then the company’s employees in their 20s, half of its headcount, generally worked in the office five days a week with those in their 30s, 40s and 50s having “more flexibility.”

Tightening Policies

Goldman Sachs’ reminder to employees comes as more companies — from other financial services giants like JPMorgan Chase to tech heavyweights including Amazon, Google and Meta — have tightened their return-to-office policies and urged employees to come in at least some days of the week. The most recent example was videoconferencing provider Zoom, the company that’s the very symbol of remote working, requiring employees living within 50 miles of its office to show up there at least two days a week.

JPMorgan has asked its managing directors to work out of the office five days a week.

JPMorgan and rival Citigroup have been tracking attendance and asking managers to implement the rules of working at least three days a week in the office for many employees, with Citigroup staffers recently told they may face consequences for failing to comply with attendance policies, Bloomberg reported.

Financial services firms, which usually have higher return-to-office rates than sectors such as tech, have been among the most active office leasing tenants in big U.S. markets, landlords have said.

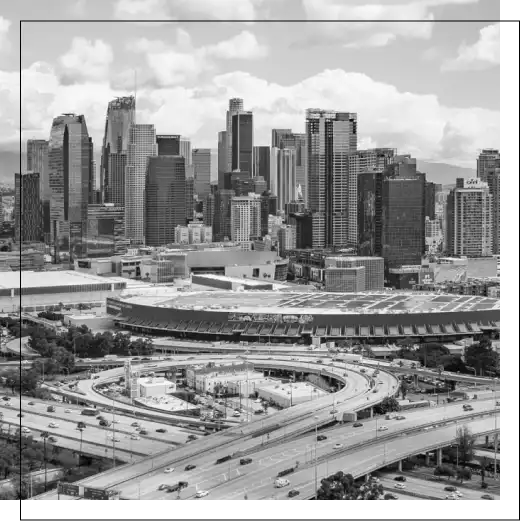

Still, whether these and other stricter guidelines could make a difference for the hard-hit office market remains to be seen. In the United States and particularly in Goldman Sachs’ home market of New York, the largest U.S. commercial property market, companies cutting back or pausing office space needs amid slow return-to-office rates and an uncertain economic outlook have led to what CoStar data shows as record-high office vacancy rates of about 13.2% each.

A rise in interest rates is seen seizing financing activity and leading to increased office defaults, compared with other property types. Meanwhile, a study published recently by global consultancy McKinsey & Company also found that behavioral workspace changes threaten a “severe and lasting impact” around the globe that’s estimated to wipe out some $800 billion in office value in nine cities, including New York, by 2030 in just a “moderate” scenario.

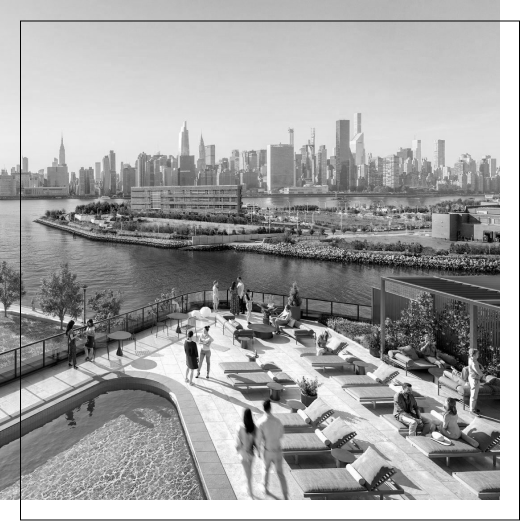

Security firm Kastle Systems’ weekly office utilization rate gauge in New York and a 10-city index have persistently been below 50% with few exceptions, a pattern that was observed even before the summer season. Its most recent weekly data showed that the average among the 10 cities it tracked declined to 47.2% in the week through Aug. 16, down from 47.3% a week earlier. Tuesday was the high point of the week again, with the 10-city average at 55.5% occupancy, while Friday continues to be the lowest day at 31.1% average occupancy last week, Kastle said.

A separate study also found that the hybrid work pattern is increasingly the norm. Between Tuesday and Thursday, same-day office employee visits in Manhattan in the first five months of this year were found to have recovered to 73% of the pre-pandemic level in 2019, while same-day visitation rates on Mondays and Fridays, also showing improving signs, trailed midweek at 61% and 47%, respectively, according to industry lobbying group the Real Estate Board of New York, citing Placer.ai mobile device location data.