WeWork recently warned in its latest earnings statement that “substantial doubt exists” about its ability to continue. The global flexible workspace provider noted an urgency to improve liquidity and profitability over the next 12 months.

Following a second-quarter drop in memberships due to increased competition and “macroeconomic volatility,” an analyst at BTIG issued a downgrade on WeWork’s stock.

Once valued at $47 billion, the coworking company reported a $397 million loss in the second quarter that it partially attributed to higher-than-expected churn in members and lower-than-expected demand. The company said it is pursuing a plan to improve liquidity and profitability over the next 12 months that includes aggressive cost-cutting efforts and restructuring or renegotiating leases with more favorable terms.

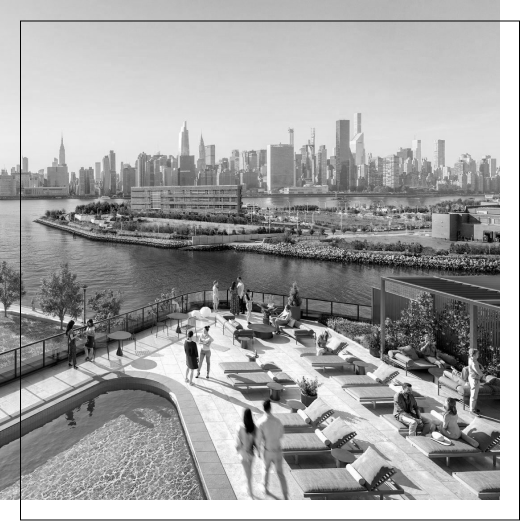

However, if the worst outcome happens, New York City would see the largest impact from a potential collapse of the company. More than 70 locations exist here following an expansion that saw nearly 13 million square feet leased by the flexible workspace provider between 2018 and 2019.

While most of the WeWork outposts are in the Manhattan borough, there also are two locations in Queens and four in Brooklyn. There are no WeWork locations in the Bronx or Staten Island.

Midtown Manhattan has the highest concentration of WeWork locations, as the Plaza District and Penn Plaza neighborhoods contain 11 locations each. The Murray Hill and Times Square neighborhoods contain a combined 15 locations.

Midtown South has the next highest concentration of WeWork locations. The most populous neighborhoods are Chelsea, with nine locations, and Gramercy Park, with six.

In Manhattan, downtown has the fewest locations. The Insurance District, the Financial District and World Trade Center neighborhoods each contain three locations.

With sublease availability already at all-time highs, New York’s office sector could face another multimillion-square-foot cache of available office space should the worst occur for WeWork.